By Ellen Harpel, President, Business Development Advisors, and Jeannette Chapman, Deputy Director and Senior Research Associate at The Stephen S. Fuller Institute

This is the final blog of three covering this report. In the first blog, we look at the major trends in non-employer establishment growth over time. In the second blog, we compare these trends in the Washington region with its peer metros. In this blog, we look at the types of work being performed by non-employer establishments in the region.

Download the full report as a PDF>>

The work performed by non-employer establishments in the Washington region mirrored that of employer establishments in 2015. The distribution of establishments, the value to the worker/owner and the relative concentration was similar for both non-employer and employer establishments. The key differences were the result of sub-sector concentrations that reflect both traditional gig economy work, real estate brokers, and the rise of the new, tech-enabled gig economy worker, especially Uber/Lyft drivers.

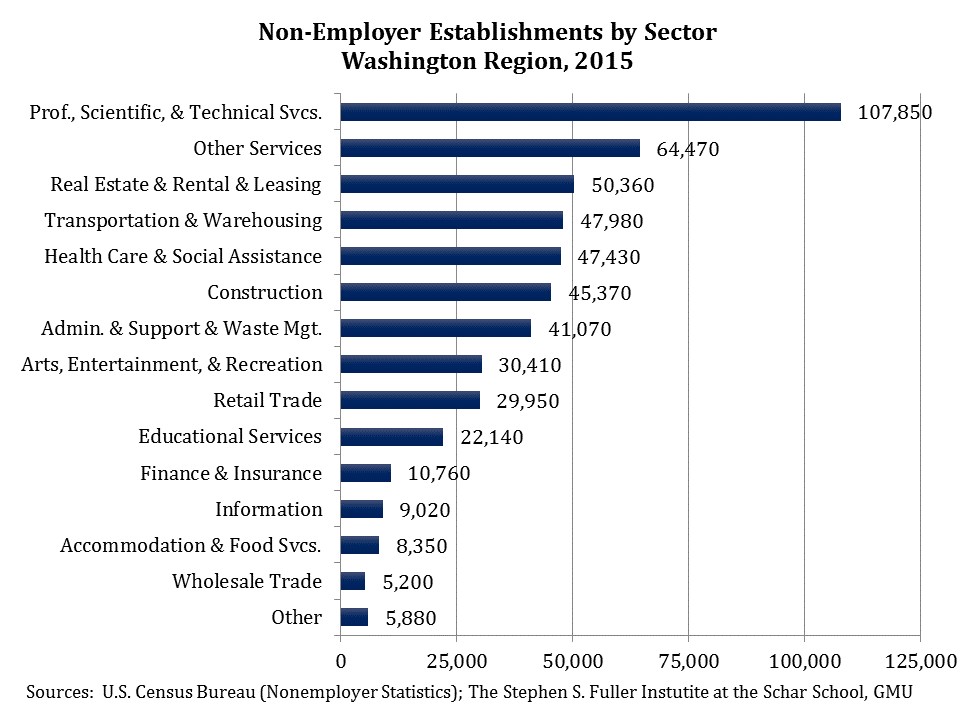

About one-fifth (20.5%), or 107,850 non-employer establishments were in the Professional, Scientific & Technical Services sector in 2015. Among employer establishments, this sector accounted for about the same share (21.7% of establishments and 20.3% of jobs) of activity. Of non-employer establishments in this sector, the majority of these establishments perform either consulting services or “other” services, the catch-all sub-category for services not defined.

The second most common sector for non-employer establishments was Other Services. This sector includes a wide array of activities ranging from personal care services to national business associations. Non-employer establishments in the Washington region were most likely to be in the Hair, Nail, & Skin Care Services sub-sector, as over one-third (35.0%) were in 2015. Nearly one-half (47.9%) were unspecified personal care services, which commonly includes personal trainers, nonmedical diet services, and tanning salons. By contrast, employer establishments were more likely to be religious or civic associations. Both non-employer and employer establishments accounted for about the same share of total establishments, at 12.3 percent and 11.2 percent, respectively.

The Real Estate & Rental & Leasing sector was the third largest sector for non-employer establishments in the Washington region in 2015. Nearly all (98.1%) of the establishments in this sector were involved in real estate and 32.3% were in the Offices of Real Estate Agents & Brokers sub-sector in 2015. Residential real estate brokers are frequently not salaried employers and excluded from traditional employment counts. Overall, the Offices of Real Estate Agents & Brokers sub-sector has also been disproportionately represented in the gig economy, accounting for a high of 6.8 percent of all non-employer establishments in 1998. In 2015, this sub-sector accounted for 3.0 percent of all establishments, despite being just 1.4 percent of employer establishments.

Establishments by Select Sub-Sectors: the gig economy

Real estate brokers, a traditional gig economy workers, were surpassed by a new type of worker in 2013, the Uber/Lyft driver. The number of Taxi & Limousine Service establishments without employees increased exponentially starting in recent years, rising from 11,190 in 2010 to 29,950 in 2015 (+167.7%). This sub-sector accounted for 5.7 percent of all non-employer establishments, more than double its share in 2010 of 2.5 percent. Of establishments with employees, this share was just 0.1 percent in 2015. Gig economy workers were also far more prevalent than their wage and salary counterparts. There were 2,345 payroll jobs in the Taxi & Limousine Services sub-sector and 29,950 non-employer establishments and likely Uber/Lyft drivers in 2015.

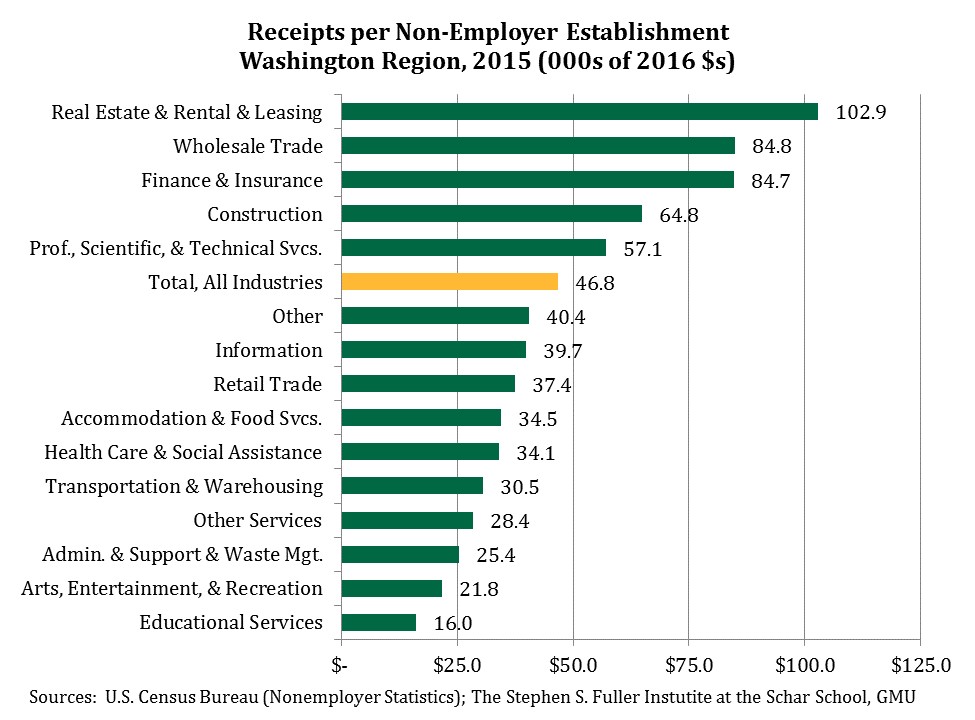

Average Receipts by Sector

The receipts per non-employer establishment in the Washington region varied considerably by sector. Real Estate & Rental & Leasing establishments had the highest average receipts ($102,930) in the Washington region in 2015, driven by the large number of real estate brokers who work full time and rely on this type of work for their primary income. The second highest receipts per establishment was the Wholesale Trade sector. Because these receipts exclude expenditures, the effective wage for this sector is likely significantly lower. The Finance & Insurance sector, with the third highest average receipts, includes a large number of investment advisors and insurance brokers. The expenditures for non-employer establishments in this sector are likely to be a smaller share of receipts, so average receipts may better reflect the effective wage.

The largest sector, Professional, Scientific & Technical Services, had average receipts of $57,140 in 2015. While this was higher than the average for all non-employer establishments, it was just over one-half (54.6%) of the average payroll for a traditional employee, suggesting that a significant number of the non-employer establishments are part-time, secondary sources of income for their owners/workers.

The fastest growing sector, Transportation & Warehousing, had significantly lower average receipts ($30,490). Within this sector, the Car & Limousine Service sub-sector (Uber/Lyft drivers) had average receipts of $21,350. The exponential rise of this sub-sector in the Washington region drove a disproportionate share of the overall decrease in average receipts in recent years.

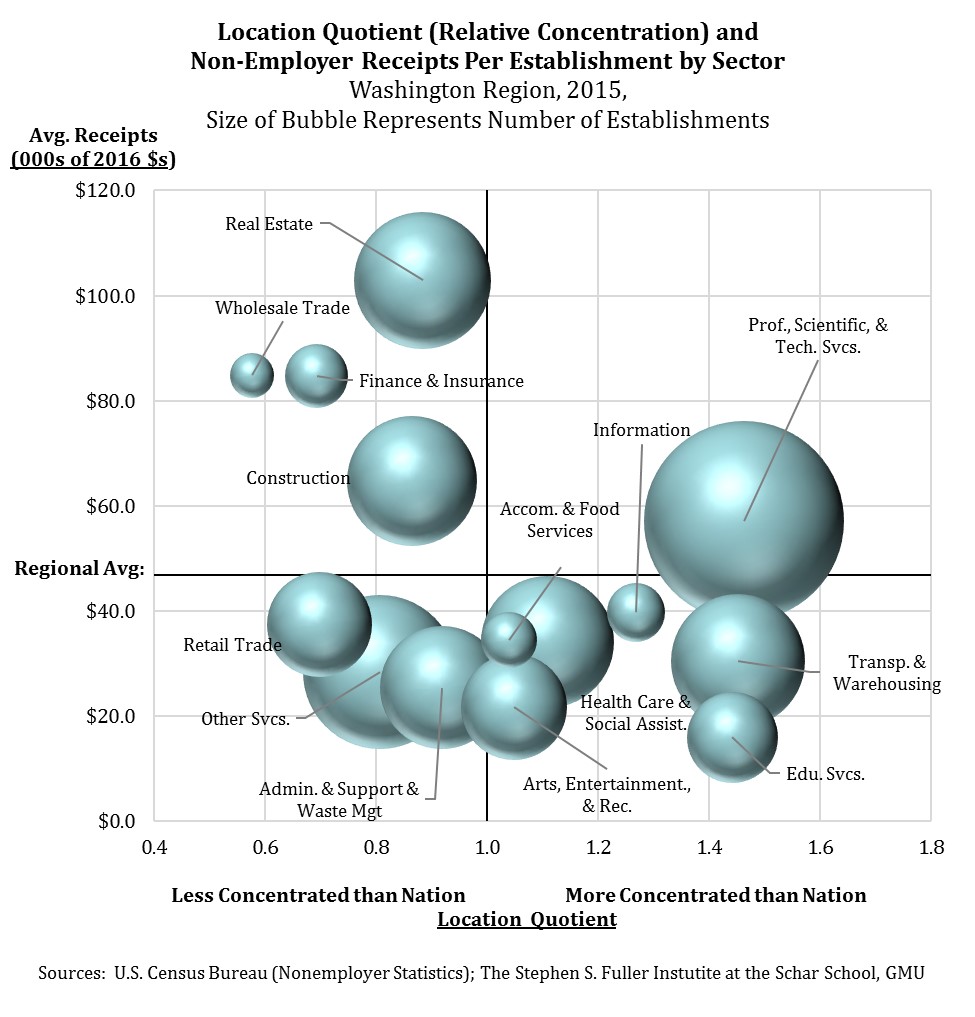

Relative Concentration by Sector

The below bubble chart shows the average receipts and the number of establishments along with a measure comparing the concentration of non-employer establishments with that of the nation. A location quotient compares the Washington region’s share of non-employer establishments in a sector relative to the national share. A location quotient (LQ) of 1.0 means that the sector is equally concentrated in the region and in the nation. An LQ greater than 1.0 indicates a higher concentration of that sector in the Washington region compared to the nation, while an LQ less than 1.0 reflects a lower concentration. A high concentration generally suggests a competitive advantage in that sector.

In 2015, the Washington region has one sector that was both over-represented in the region compared to the nation and had higher-than-average receipts: Professional, Scientific, & Technical Services (top right quadrant of bubble chart). Both non-employer and employer establishments in this sector were relatively high-value and highly concentrated, suggesting that a competitive advantage exists for all workers in this sector, regardless of their organizational type.

The Transportation & Warehousing sector had the second highest concentrated of non-employer establishments in the Washington region in 2015. This sector also had lower-than-average receipts (bottom right quadrant in bubble chart). Both the relative concentration and lower receipts were driven by the Taxi & Limousine Services sub-sector. While a similar concentration also existed for employer establishments in the Taxi & Limousine Services sub-sector, this sub-sector accounted for a significantly smaller share of the Transportation & Warehousing sector, overall. The other activities in this sector, especially Truck Transportation, were underrepresented in employer establishments in the Washington region. As a result, employer establishments were less concentrated in the Washington region compared to the nation.

The private sector Educational Services sector also had a high concentration of non-employer establishments and low average receipts in the Washington region in 2015. Employer establishments in this sector were also highly concentrated in the Washington region. No sub-sector data is available, but this may reflect a large number of tutors in the region.

Overall, the sector-level patterns of non-employer establishments mirrored the patterns of establishments with employees. Both non-employer establishments and employer establishments had high concentrations in three key sectors: Professional, Scientific, & Technical Services; Educational Services; and Information. In the four additional sectors that were highly concentrated for non-employer establishments but not for employer establishments, the difference was typically due to the sub-sector mix, like with Transportation & Warehousing sector. Similar to employer establishments, about one-quarter of non-employer establishments were in one of the Washington region’s advanced industrial clusters in 2015.

Conclusion

The rapid growth of non-employer establishments is a notable feature both in the Washington region and throughout the nation. This growth reflects changes in the way work is done and a growing share of activity is being conducted through less traditional employment structures. Non-employer establishments in the Washington region have had faster growth than in the nation and in majority of the largest metros areas.

In the Washington region, non-employer establishments supplement wage and salary work, mirroring the composition of traditional wage and salary establishments with two notable exceptions. Both real estate brokers and Uber/Lyft drivers are more concentrated in non-employer establishments, representing the traditional and new gig economy worker. Despite the differences in concentration, the Washington region has a competitive advantage in the same sectors for both non-employer establishments and traditional wage and salary employment.

As technology enables more non-traditional forms of work, it seems likely that growth in non-employer establishments will continue to outpace traditional wage and salary employment. The traditional measure of jobs will increasingly undercount the economic activity in the Washington region, and in the nation, and may mask shifts in the region’s economic base.

About These Data

All non-employer statistics are from the U.S. Census Bureau’s Nonemployer Statistics Datasets. Employer statistics are from the U.S. Census Bureau’s County Business Patterns. For all metro areas, the 2013 metropolitan statistical definitions were used, aggregating from the county-level files. National data are from the United S