REGIONAL ECONOMIC NOTE No. 23-9

Keith Waters and Terry Clower

Download Full Report as a PDF >>

The Washington region’s economy has undergone notable changes since the outset of the pandemic. Work-from-home both increased the amount of time spent at home and reduced the need to commute to the office every day of the week, effectively making it feasible to live farther from work. At the same time, materials and labor supply disruptions drove up construction costs for new housing, affecting rental and owner-occupied markets. Additionally, ultra-low interest rates increased the ability for would-be home buyers to bid up housing prices. Then in 2022, in response to inflation concerns, the Federal Reserve Bank started a series of interest rate hikes that resulted in mortgage rates more than doubling over a few months and slamming the brakes on home sales. This Regional Economic Note assesses developments in median sales price changes for existing homes in the Washington region in the wake of rapid changes in key market conditions.

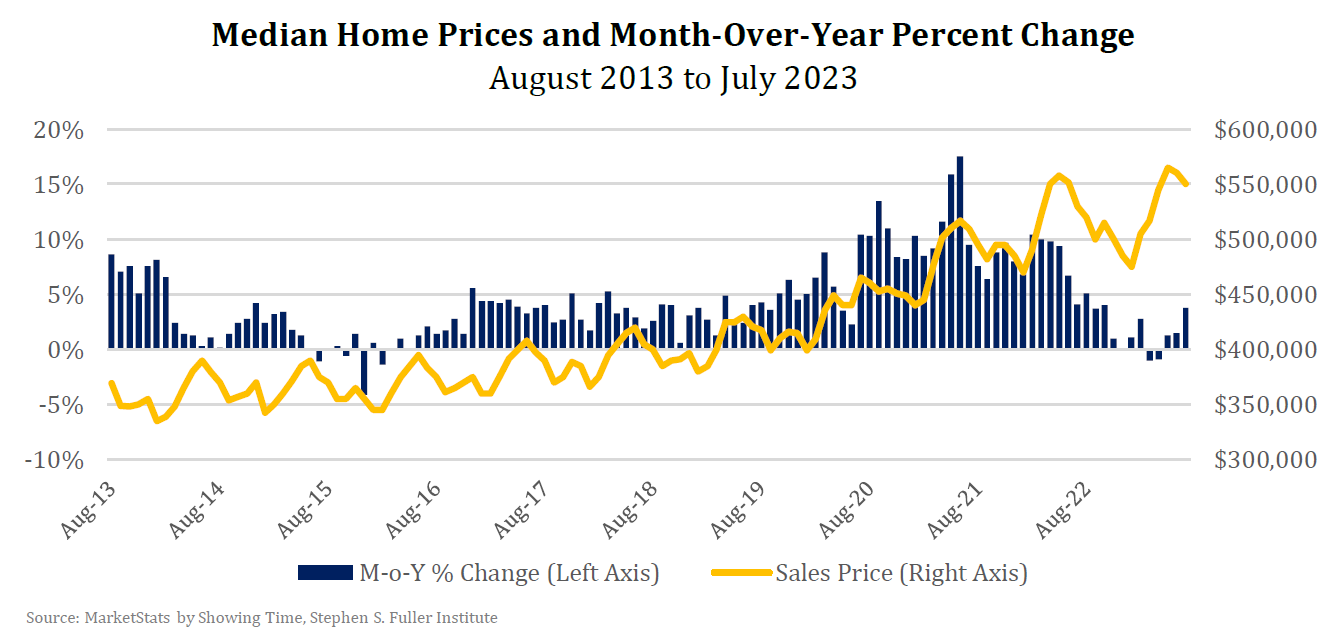

While the median sales price of sold homes in the Washington region has increased roughly 50% over the past decade, most of the increase occurred in the wake of the pandemic. From August 2013 through July 2019, the median sales price of sold homes increased 14.0% from $369,347 to $421,065. As pandemic conditions and related government and business policies impacted the housing market, median prices in the region increased dramatically. By July 2020, the median price of sold homes was $465,000, 25.9% greater than in August 2013. From March 2020 through July 2022, the median sales price in the Washington region increased month-over-year by an average of 9.0%. While price growth cooled as the Federal Reserve raised interest rates to combat inflation, the median price of sold homes in the Washington region stood at $550,000 in July 2023, 48.9% greater than the median sold price in August 2013.

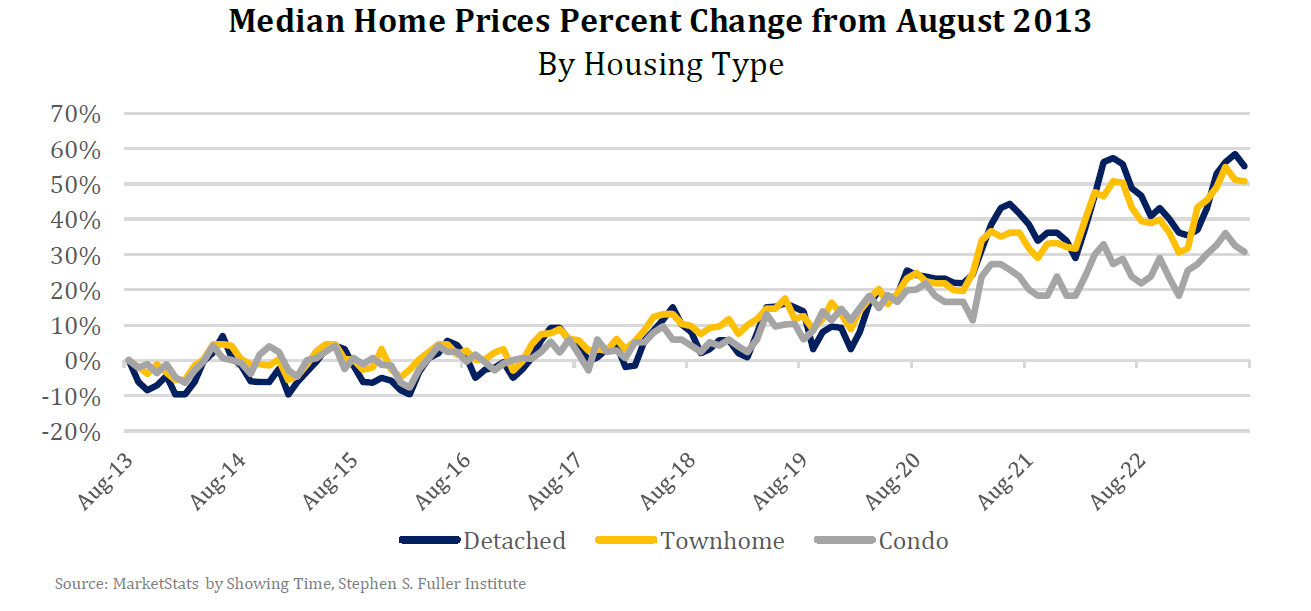

While price growth among housing types was broadly similar prior to the pandemic, median sales price growth of single-family detached and townhomes far outpaced median sales price growth of condos in the wake of the pandemic. From August 2013 to July 2019, the median sales prices for detached homes increased 15.0%, 11.7% for townhomes, and 10.4% for condos. By July 2023, however, the median sales price for detached homes had increased 54.9% from August 2013, with the median sales price of townhomes increasing 50.7% over the same period. In contrast, the median sales price for condos increased 30.7% from August 2013 to July 2023. While median price growth for single-family detached and townhomes has continued to outpace condos, it is worthwhile to note that condo prices have continued to climb, albeit at a slower pace than single-family detached and townhomes.

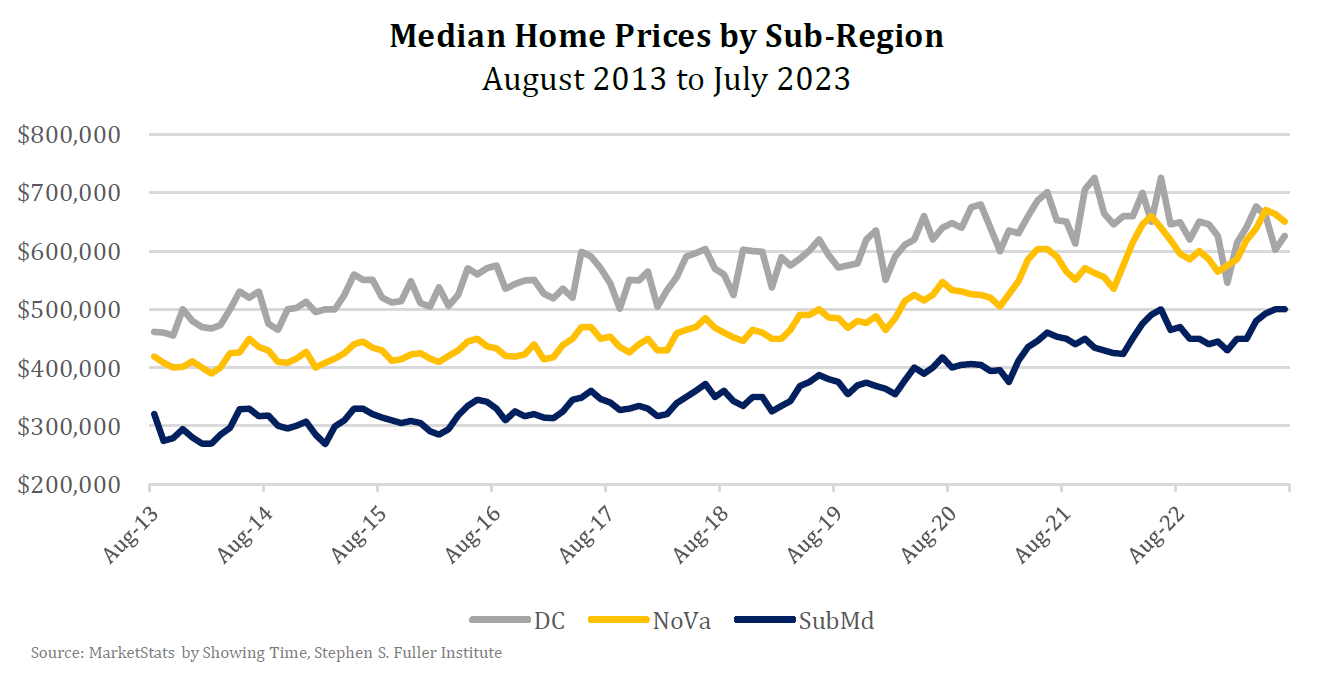

Examining the median sales price of sold homes by sub-state region reveals that while DC, Northern Virginia, and Suburban Maryland were increasing at similar rates prior to the pandemic, median prices in DC have since stagnated. See a note regarding geography in the About These Data. From August 2013 to July 2019, the median price of sold homes increased 28.5% in DC ($461,000 to $592,500), 15.9% in Northern Virginia ($419,022 to $485,800), and 18.8% in Suburban Maryland ($320,000 to $380,000). However, since the onset of the pandemic, housing prices in DC stagnated while they continued to climb in Northern Virginia. From July 2019 to July 2023, the median price of sold homes increased 33.8% in Northern Virginia to $650,000, and 31.6% in Suburban Maryland to $500,000. In contrast the median price of sold homes in DC increased just 5.5% from July 2019 to July 2023 to $625,000. Notably, the median sales price of sold homes in Northern Virginia topped DC in May 2023, for the first time in at least a decade.

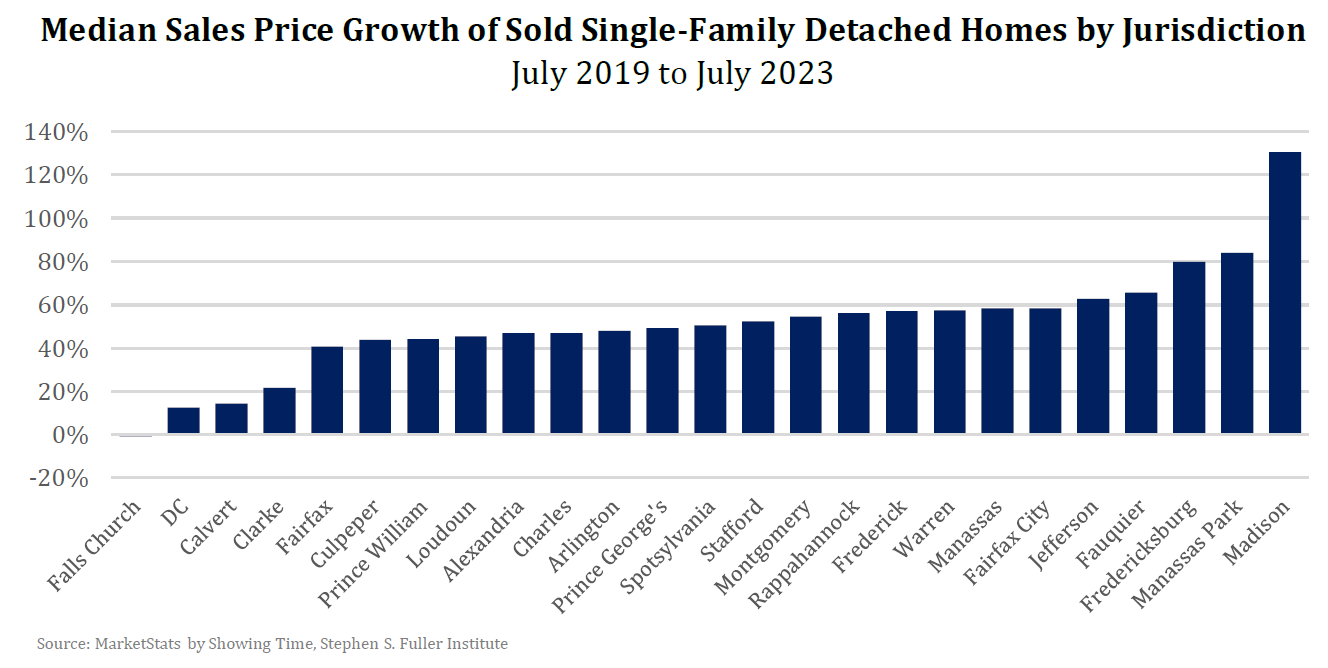

To get a sense of how the housing market has changed within the Washington Region, the percent change of the median price of single-family detached homes in Washington region jurisdictions from July 2019 to July 2023 are examined. Given that DC has a greater share of its housing stock accounted for by condos than Northern Virginia and Suburban Maryland, only single-family detached homes are examined. Within the Washington region, the 5 jurisdictions with the greatest median price growth are all on the geographic edge of the region: Madison County, VA; Manassas Park, VA; Fredericksburg, VA; Fauquier, VA; and Jefferson County, WV. Among the three largest jurisdictions (Fairfax County, VA; Montgomery County, MD; and DC), Montgomery County recorded the largest increase in median sales price of sold homes over the period (54.5%). Only one jurisdiction in the region, Falls Church, recorded a decline in the median price of sold homes (-1.0%).

Conclusion

The median sales price of homes sold in the Washington region was growing notably in the lead up to the pandemic. The onset of the pandemic and ultra-low interest rates led to considerable price growth from late 2020 through late 2022 when the federal reserve began to hike interest rates. While price growth has cooled, the median price of sold homes remains elevated. The slower price growth is primarily the result of slower price growth of condos, as the median sales price of single-family detached homes and townhomes have continued to climb even in the face of elevated interest rates. Among sub-regions, the median price of homes in Northern Virginia and Suburban Maryland have continued to grow while prices in DC have stagnated, partially the result of a higher share of condos in DC. Indeed, the median price of sold homes in Northern Virginia surpassed DC in May 2023 for the first time in over a decade. Examining single-family homes among the region’s jurisdictions reveals that within comparable home types, jurisdictions on the edge of the region tended to outperform those closer in.

Moving forward, the median sales prices of existing homes are likely to continue to rise despite higher rates due to lack of inventory. During the period of ultra-low interest rates, inventory in the area sank to historic lows after homeowners locked-in ultra-low interest rates, making them less likely to sell. Additionally, anecdotal evidence suggests that homeowners spent a larger portion of their disposable incomes on remodeling their homes. Low interest rates combined with customized homes will likely lead homeowners to remain in their homes, resulting in lower inventory and prices high in the near term.

About These Data

All data are from BrightMLS via MarketStats by ShowingTime. BrightMLS is the multiple listing service that services the Mid-Atlantic region. Monthly data on MarketStats by ShowingTime are typically released by the 11th of the following month. The geographic definition of the Washington region used by MarketStats excludes Madison County, which is included in the Metropolitan Statistical Area definition of the region defined by the Office of Management and Budget. The geographic definition of Suburban Maryland used by MarketStats only includes Montgomery County, MD; and Prince George’s County, MD. Not included are Calvert County, MD; and Charles County, MD. The geographic definition of Northern Virginia used by MarketStats does not include Clarke County, VA; Culpeper County, VA; Fredericksburg City, VA; Prince William County, VA; Rappahannock County, VA; Spotsylvania County, VA; Stafford County, VA; or Warren County, VA. The counties listed that are excluded for Suburban Maryland and Northern Virginia are, however, included in the Washington Region definition used.