This post is a summary of the report on Demographic and Economic Factors Affecting the Upcoming Home Sales Market.

Download this Summary>>

Download the Full Report>>

Baby Boomers and older adults, in general, are the dominant force among the region’s and the nation’s home owners. Nationally, discussion in the popular press about the “Baby Boomer Sell-Off” began in 2013[1] but this trend has not yet come to fruition, in part because of economic trends including delayed retirement as a result of the Recession and a decreased likelihood of these owners having paid off their mortgages entirely.[2] Home owners in the Washington region have followed a similar pattern.

The post-Recession housing market performance has been uneven both in terms of volume and price growth. Low inventory has not resulted in larger-than-average price increases. Key factors suggest a continuation of these prior trends in the future:

- The average wage in the Washington region was slow to return to its 2010 peak and, while wages are projected to have stronger gains going forward, growth is forecasted at about one percent per year.

- Economic growth and demographic patterns suggest subdued population growth in the near-term as a result of continued net domestic out-migration.

However, there is a significant number of older owners living in homes that may no longer suit their needs. Nationally, some experts predict that the sell-off will begin in the mid-2020s.[3] At first glance, this conflicts somewhat with how Baby Boomers respond in surveys. A Demand Institute survey of Baby Boomers in 2013 showed that only 37 percent planned to move from their current home.[4] A survey of owners aged 55 years and older conducted by Freddie Mac in 2016 had a similar finding: 63 percent preferred to age in place.

Because of the large presence of Baby Boomer owners, even if only 20-30 percent of Baby Boomer owners decide to sell in the upcoming years, the effect on the nation’s and region’s housing market would be significant. In the Washington region, this would result in upwards of 100,000-150,000 new homes on the market. For comparison, there were 85,720 home sales in the Washington region during all of 2017. Altogether, only a relatively small share of the Baby Boomer owners in the region would need to sell in order to have an outsized effect on the region’s housing market, especially in the neighborhoods with higher concentrations of these owners.

Home Ownership Trends in the Washington Region

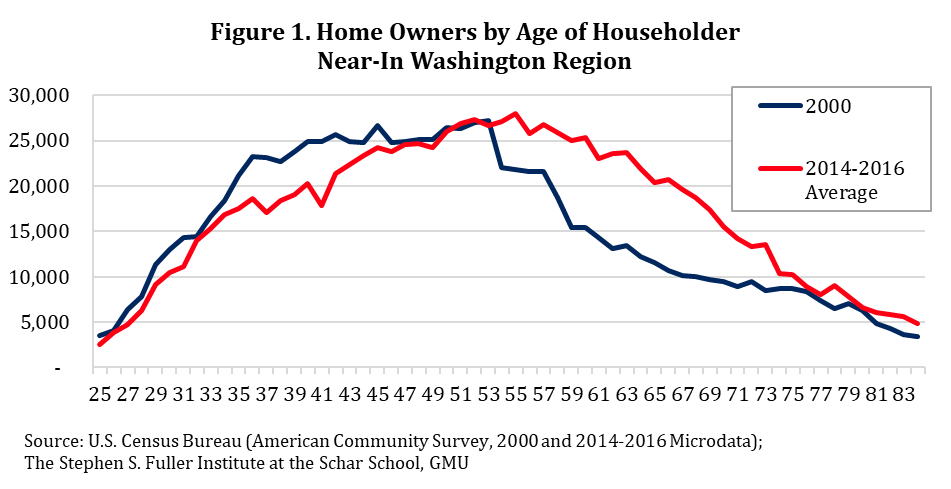

Home owners in the Near-In Washington region[5] were far more likely to be headed by someone between 52 and 70 years old during recent years, and this age group accounted for 41.6 percent of all owners during the 2014-2016 period. For comparison, in 2000 householders in this age range accounted for just 32.0 percent of all owners.

This trend is primarily due to demographics, not significant changes in housing preferences (Figure 2). A larger share of the region’s population was older than 50 years old during the recent period compared to 2000, a difference driven by significant presence of the Baby Boomer generation in the region. Home ownership rates for much of this age group differed little in the recent period when compared to 2000. Householders aged 65 years old and over were somewhat more likely to be owners than in 2000. This may reflect improved health and technology that allow for adults to remain in their homes for longer.

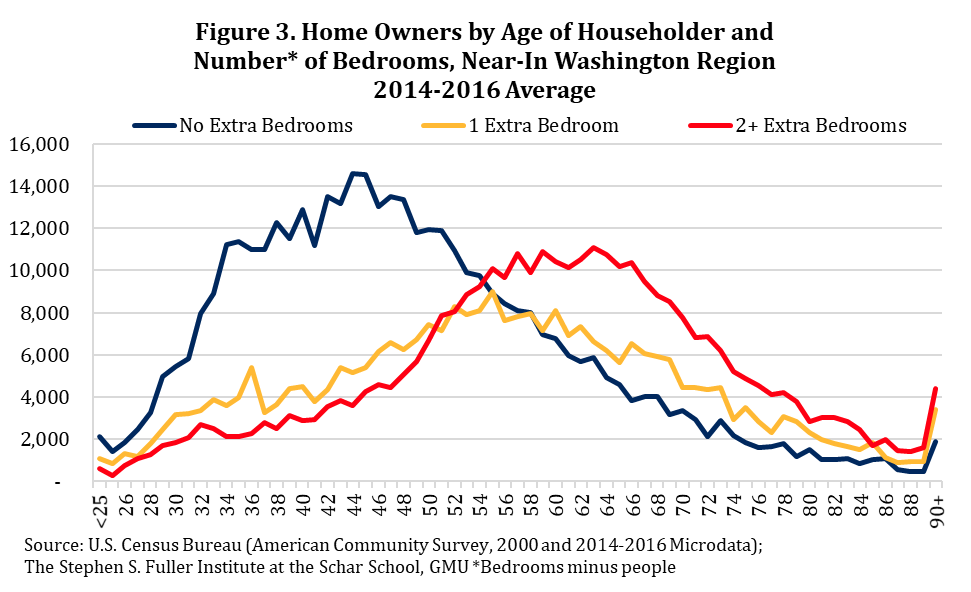

As households age, they are more likely to become empty nesters with more bedrooms than people living in the home (Figure 3). For married couples sharing a bedroom, this calculation will underestimate the number of extra bedrooms. For example, a two-person married couple who lives in a home with three bedrooms will have one more bedroom than people and be shown as having just one “extra” bedroom in the graph below. Even with this conservative estimate, more than 273,540 households headed by someone 50 years old or older had two more bedrooms than people in their home during the 2014-2016 period. This accounts for more than one-quarter (25.8%) of all owners during this period.

The significant number of older home owners in larger homes means that even a modest shift in preferences could have an outsized impact on the housing market. If just three percent of owners aged 50+ with two or more extra bedrooms decided to sell, an additional 8,210 homes would be put on the market, the equivalent of 12.4 percent of all the homes sold in the Near-In Washington region in 2017. In other words, a change in behavior of a small share of a very specific type of older owners would still result in a 5-10 percent increase in the supply of homes for sale during a single year.

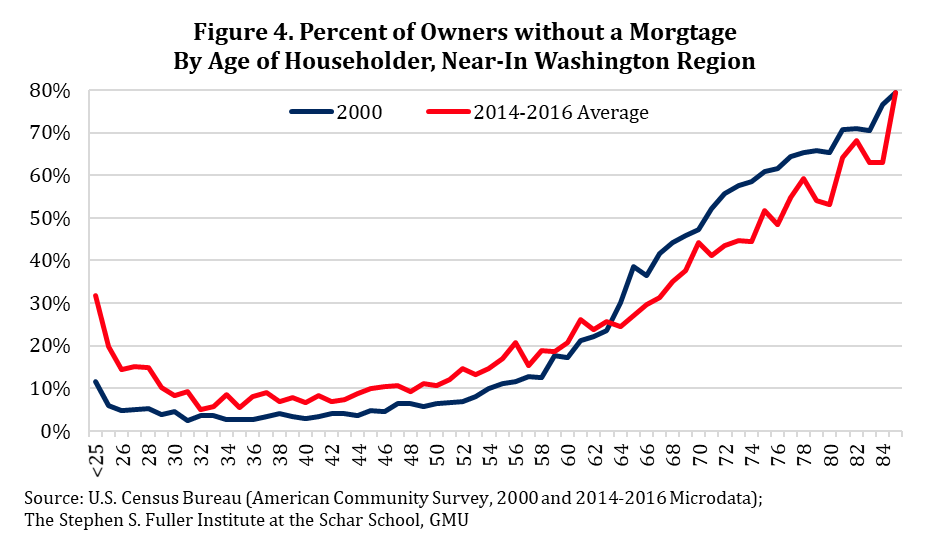

There are two potential moderating factors: a smaller share of homes owned free and clear, and lower mobility rates. As shown in Figure 4, younger adults who owned were less likely to have a mortgage during the recent period when compared to 2000. For adults aged 63 years old and older, the reverse was true. The presence of a mortgage may alter a potential mover’s decision, especially if a low interest rate was locked-in during the past several years.

A second complicating factor is the overall decrease in mobility rates, both in the Near-In Washington region and the nation.[6] Because mobility rates have been decreasing since the late 1980s nationally, it seems unlikely that this trend will reverse in the upcoming years. For the Near-In Washington region, the lower mobility rates may continue to contribute to a less dynamic housing market.

Over the next five to ten years, it seems increasingly likely that a portion of older home owners will want to transition from their current homes into ones that better suit their needs, both in the Washington region and in the nation. Just like any other home seller, their ability to do so will be highly contingent upon finding the right unit type to purchase and being able to sell their current home. The near-term economic forecast is for average growth. Population growth is also likely to slow. In the past five years, these factors have played a role in the modest home price appreciation, despite tight inventory. Based on these prior trends, an increase in homes on the market could create some volatility in the housing market, especially at the neighborhood-level.

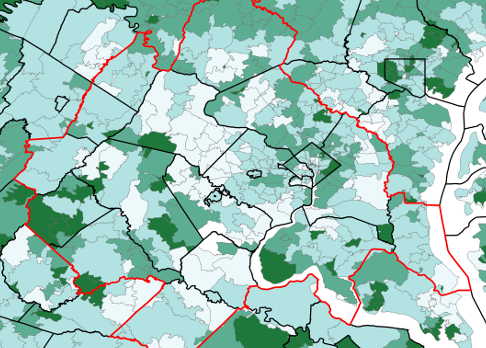

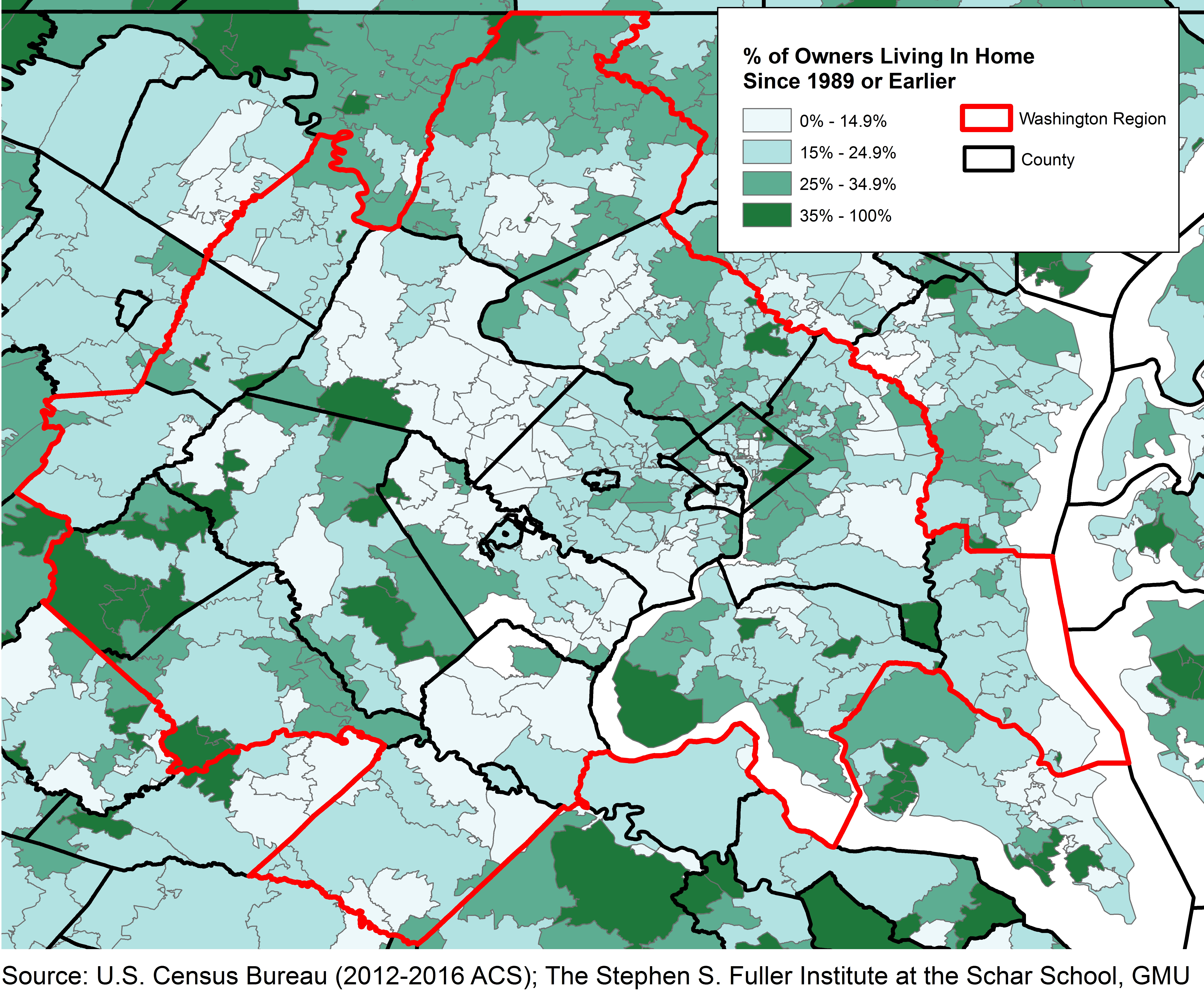

Of owners in the Washington region during the 2012-2016 period, 18.9 percent moved into their homes prior to 1989 and had lived in their homes for more than 23-27 years (longtime owners). As shown in Figure 6, the share of longtime owners varied considerably by ZIP code, with a larger share of longtime owners in most ZIP codes inside the Beltway. The ZIP codes with a high concentration of longtime owners have the most potential for higher turn-over rates in the upcoming years, if Baby Boomers do decide to sell.

Unsurprisingly, neighborhoods with a large share of longtime home owners had lower turn-over rates. As a result, the inventory in neighborhoods with a large share of longtime owners has been more constrained. This reduced availability of homes appears to have put increased price pressure on the units that have sold: ZIP codes that had a large share of longtime home owners had larger-than-average gains in sales prices between 2010 and 2017. It seems likely that this above-average growth in sales prices has reflected, in part, a broader lack of supply in these ZIP codes. As the inventory increases, the growth may moderate.

Conclusion

The Washington region’s housing market is facing several headwinds. Key trends that have shaped the recent housing market, modest economic growth and slowing population growth, are expected to continue in the near-term. However, inventory may increase as longtime home owners, primarily Baby Boomers, downsize or trade product types. In combination with rising interest rates and high levels of student debt among potential buyers, the housing market may be on less stable footing going forward.

However, there may be potential buyers waiting in the wings. In 2016, more than 69,300 renter households headed by someone younger than 50 years old earned at least $150,000. Many of these households wish to buy. Another 151,500 households own homes that have no extra bedrooms, earn more than $150,000 and are headed by someone younger than 50 years old; this total includes 28,100 households earning more than $300,000. These households may wish to trade-up, but have been unable to do so because of limited stock. These potential buyers are likely to be highly discerning and willing to live in their current housing situation, either as renters or in too-small homes, until the right unit comes along for the right value. Potential buyers appear to have learned their lessons from the housing bubble and seem to be more unwilling to purchase for the sake of ownership.

As a result, the near-term housing market has the potential to be more dynamic than in past years. Some longtime owners who wish to sell may have difficulty attaining the price gains they witnessed in their neighborhoods during recent years, when inventory was limited, especially if their neighborhood has a large number of longtime owners who put their homes on the market at once. Some owners may be willing to sacrifice some upfront value for increased happiness they may attain through moving; some research shows that older movers generally express a higher degree of overall psychological well-being compared to those that have not moved.[7] Others may decide to postpone their move.

Potential buyers may continue to be patient and highly selective. Homes that fit their criteria, driven both by location and the features of the property, will likely sell quickly and potentially gain in pricing. Altogether, the sales patterns and pricing in upcoming years will be highly spot- and unit-specific. Neighborhoods with a large share of longtime owners will have the most volatility in the upcoming years.

[1] For an example, see https://www.citylab.com/equity/2013/03/aging-baby-boomers-and-next-housing-crisis/4863/. Academics began examining this trend much earlier, with research being published as early as 2008. For an example, see Dowell Myers and SungHo Ryu, “Aging Baby Boomers and the Generational Housing Bubble: Foresight and Mitigation of an Epic Transition,” Journal of the American Planning Association 74, no. 1 (January 31, 2008): 17–33. This footnote and the sentence it references was updated on July 30, 2018.

[2] http://www.jchs.harvard.edu/housing-a-growing-population-older-adults

[3] http://realtormag.realtor.org/daily-news/2017/04/20/big-boomer-sell-coming-in-2020s

[4] http://demandinstitute.org/baby-boomers-and-their-homes/

[5] Frederick, Montgomery and Prince George’s counties in Maryland, the District of Columbia, and Arlington, Fairfax and Prince William counties and the cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park in Virginia

[6] See https://www.census.gov/newsroom/blogs/random-samplings/2017/01/mover-rate.html

[7] Calvo, Estaban, Kelly Haverstick, and Natalia Zhivan (2009), “Determinants and Consequences of Moving Decisions for Older Americans,” 11th Annual Joint Conference of the Retirement Research Consortium.